I spoke at a plenary meeting for federal, state and private enterprise energy experts yesterday at the Honolulu Convention Center. It was put on by the Department of Business, Economic Development and Tourism. I want to share my speech here, too:

Aloha Everyone,

We farm 600 fee simple acres on the Big Island. I am the only person from Hawai‘i to have attended what is now four Peak Oil conferences. I went to the first conference so I could learn about oil, and figure out how to position our farm for the future.

I have an accounting degree. But, as a farmer, I would say our biggest strength is that we are good at adapting to change.

Here are some key observations:

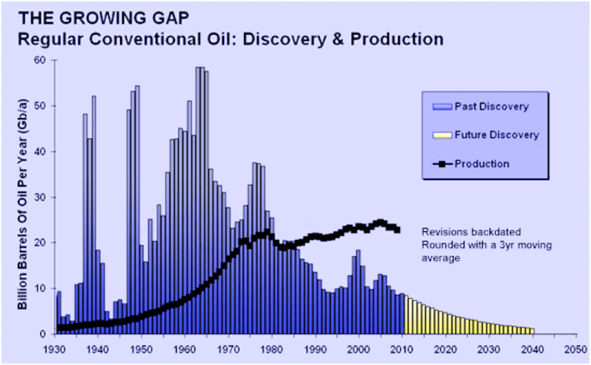

1. The world has been using twice as much oil as it has been finding for more than 20 years. And that trend continues.

2. Economies run on energy. If you take a chainsaw and a gallon of gas, you will cut so many trees. If you take that chainsaw and a half gallon of gas, you will cut less. It’s the same for the world economy. Energy growth is tied to economic growth. If energy is not available in sufficient amounts, the economy cannot keep on growing.

3. “Energy Return on Energy Invested.” It is the net energy that is available for society to use that is important.

In 1930, to get 100 barrels of oil it took the energy of one barrel.

In 1970, to get 30 barrels took one barrel.

Now, it’s 10 or 15-1 and decreasing.

Oil shale and tar sands are in the 5-1 range.

Biofuels is less than 2-1.

But geothermal is at least 10-1, and will last for 500,000 years.

It is estimated that we need 4-1 just to maintain our present society.

The net energy that is available for the use of society is getting gets less and less. In order to stay even, we will need more and more of the low EROI stuff just to stay even. Using geothermal to make electricity costs only half as much as oil.

With the world in recession, the oil price is at $100 per barrel. It seems like we are at the edge of starting down the backside of the oil supply curve. As oil supply starts to decrease, the net energy available decreases too but at an increasing rate.

One may reasonably assume that we are facing permanent recession or worse.

Another way of looking at it is: Net energy minus the energy it takes to get our food equals our lifestyle.

What can we do? The Big Island will be over the hot spot for 500,000 to a million years. The EROI for geothermal is stable and will stay the same for 500,000 years.

Consumer spending is two-thirds of our economy. Affordable energy is key. Let’s all work together to find the solution that works for the community, the environment and the economy.

Iceland is energy- and food-secure. They became that way by using low-cost hydroelectric and geothermal energy. They use their cheap electricity to make aluminum, and with the hard currency from that, they buy the food that they cannot grow. It can be done, but we must force the change!

At the early ASPO conferences, EROI used to be “fringe” thought, and now it is mainstream. We need to consider this in our planning!

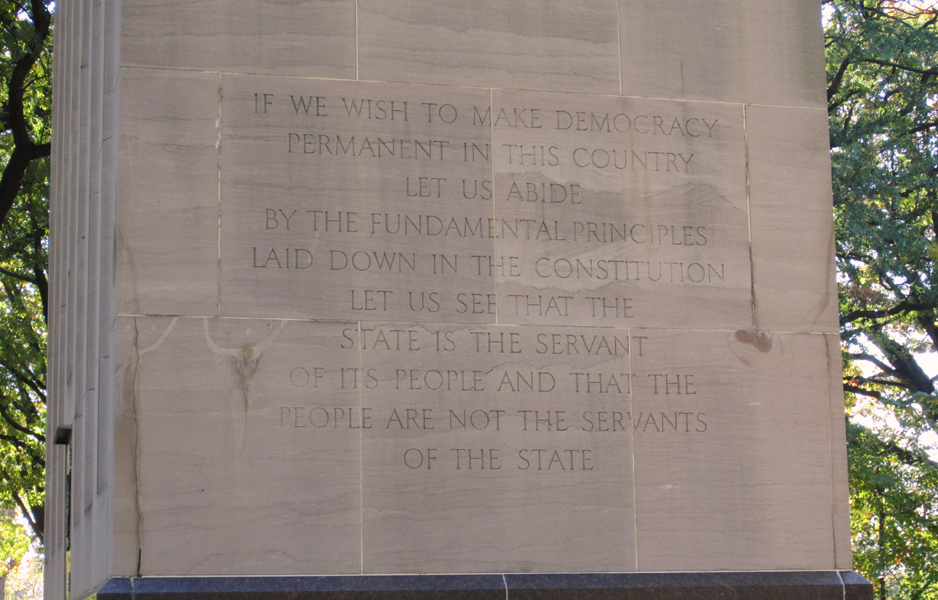

We are at a pivotal moment in Hawai‘i’s history. Business as usual is no longer safe. Like the ancient leaders who made the decision to send the canoes up from the south, we are about to make decisions that will decide the future for coming generations.

We here in this room will make the commitment. If not now, when? If not here, where? If not us, who?

We can do this. Not, no can. CAN!