In an article in yesterday’s Honolulu Star-Advertiser, Hawaiian Electric Company (HECO) Vice President Robbie Alms talks about how current increases in electricity rates are due to forces beyond our control, and says that customers should “brace for an extended period of high electricity prices.”

The article mentions that HECO is starting to run educational spots on TV to explain what is going on.

HECO sees electric prices staying high

The utility will begin airing TV ads tonight explaining reasons behind the rate hikes

By Alan Yonan Jr.

POSTED: 01:30 a.m. HST, Dec 23, 2011

Hawaiian Electric Co. is launching its first-ever public awareness campaign telling customers to brace for an extended period of high electricity prices.

Electric rates on Oahu have hit record levels in four out of the past five months largely due to an unprecedented hike in the cost of petroleum-based fuel, which the utility burns for more than 75 percent of its electricity production. Read the rest

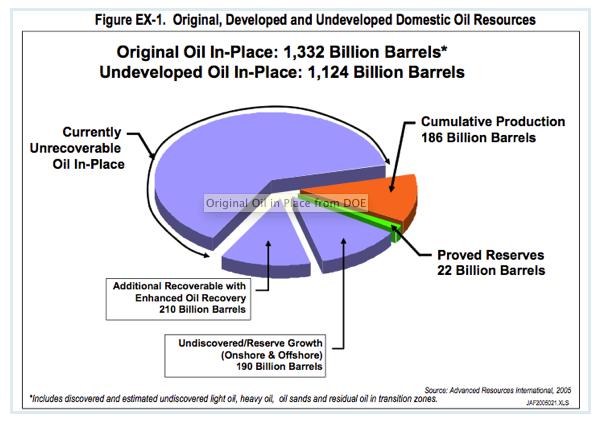

I’ve been to four Peak Oil conferences now. During the first, in 2007, I learned that the world had been using twice as much oil as it had been finding for the past 20 years (and that trend continues). Ever since, I have been trying to educate folks so we can transition to more sustainable energy sources in an orderly manner.

At the time, one could not tell if the leveling off of oil production since 2005 was the beginning of a trend or not.

By 2009 though, at the time of the Peak Oil conference in Denver, we could see that the leveling off of oil production continued. At that time, I started paying attention to an idea that Professor Charles A.S. Hall called Energy Return on Energy Invested (EROI).

The idea: It is the net energy, resulting from the effort to get that energy, that is what society can use. The more difficult it is to get oil in its final usable form, the less net energy that’s available for society to use.

By 2010, Lloyds of London had issued a white paper alerting its business clients to be prepared for $200/barrel oil by 2013. By then, it was generally agreed that oil fields begin, peak and decline in a bell-shaped curve. And the decline rate of all the world’s oil fields could be estimated to within reasonable limits, say between 3 and 6 percent.

So the natural decline rate would be between 2.5 and 5 million barrels/day each year. Since Saudi Arabia produces 10 million barrels per day, we would need to find the equivalent of a Saudi Arabia every four years. Or, in the worse case scenario, every two years.

Renewables would have to fill that amount just for us to stay even.

Somewhere along the way, I picked up that our world economy is about manufacturing – building or making things – and that takes energy. But if the primary source of energy is not increasing, could it mean that the world economy cannot grow? It sounds plausible.

By this most recent Peak Oil conference, in October – and as recent events are starting to show – it looks like there is a fundamental change occurring in the oil market. Normally, one would expect to see the price of oil declining in a recession. But something different is happening: Oil costs close to $100 per barrel.

In China, the per capita usage of oil is around 2, while in the U.S. the per capita usage is around 26. At $100/barrel oil, China’s economy is still growing. The upside of this is that we have a cushion.

If oil supply is not able to keep up with demand, it seems reasonable that the price of oil will be rising. If this results in higher gas and electricity costs, it will put a drag on consumer spending, two-thirds of which affects economic growth.

The EPA is requiring upgrades to oil-fired plants, which will cost ratepayers even more.

It feels like we will be starting down the backside of the oil supply curve soon. And as it becomes more difficult to get oil, the net oil available to society will be less and less.

We in Hawai‘i are so lucky to have geothermal as an option for base power electricity, which is 80 percent of our electricity use. Geothermal is proven technology, environmentally benign and it’s affordable: Geothermal-generated electricity costs less than half that of oil at today’s price, and the cost will stay stable for 500,000 to a million years.

As the price of oil rises, and if we rely on affordable geothermal for a large portion of our electricity base power, our economy will become more competitive compared to the rest of the world, and our standard of living will rise. Our farmers and food manufacturers will become more competitive and Hawai‘i will become more food secure. Our young people will be able to find jobs at home.

I saw the first of the new HECO television spots a short time ago. Congratulations to HECO for starting them. There is a huge amount of catching up to do. It will be a challenge.

If we move urgently toward affordable energy, we will strengthen our Aloha way of life – where people aloha and take care of each other. Together we can make a better tomorrow for all.

Happy Holidays!