High school students from the charter school Kua O Ka La came to Hamakua Springs the other day on a field trip.

Richard talked about how great it was to connect with that school, which is located on the ocean at Pu‘ala‘a in Puna, right next to the Ahalanui warm pond. “They are off the grid and all their computers are run by solar,” he said. “They have composting toilets that are very sanitary. They live on, and with, the land. I really like their hands-on learning style. They live sustainability.”

From Kua O Ka La’s website:

Pu`ala`a is an intact ancient Hawaiian village complete with historical sites, fishponds, and native habitat that affords an ideal outdoor learning environment for our project-based curriculum.

Kimo Pa, the farm’s manager, told me that he and his wife Tracy Pa were surprised, and pleased, at how interested the students were.

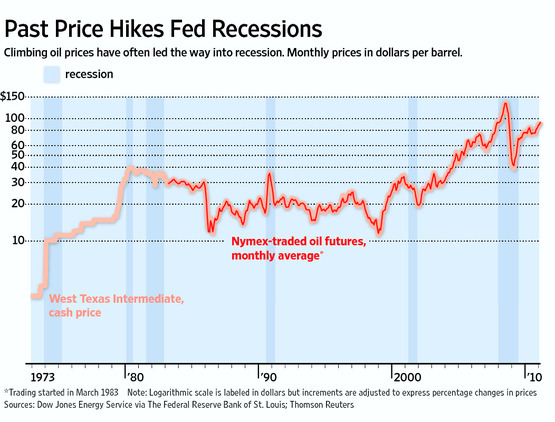

“We told them about what Richard has been working on,” said Kimo, “wondering how we are going to adapt to the new way of doing business, and to the high cost of oil. I talked about how we looked into Peak Oil, studied it for a few years, to really understand it. And how Richard got to the point of looking at geothermal and how he can help the rest of the community.

“We told them we’ve been looking at our resources here. We had water, so we could make hydroelectric….

“I told them that Richard said, ‘What about our workers, the island, the state? What resources do we have that could help the rest of the people?’ That’s how he found geothermal. Now he’s working with Ku‘oko‘a.

“They were really into that part, and had questions,” he said. “This has to do with their community. They’re next to the warm pond. Why is that water hot? Because of the volcano.”

He told the students that our huge dependence on oil now has to do with the leaders we have picked over the years, and their decisions.

“I told them how important they are as an individual, and that it’s their responsibility to pick the leaders; that their vote counts, because they are the future leaders. That their decision making is for the generations under them.”

He showed the students the farm’s hydroponics system, the tomatoes, and the fish they are raising.

“And I explained that we are working with other farmers, and that we like to employ people from nearby,” he said. “Working with other farmers, we can produce more food. We want to fit into the community and grow food for the area. It’s all about the sustainability – taking care of your neighbor, doing the right thing for your community so in the next generation, and the next generation, things don’t get worse.”

It’s a perfect fit with the school’s vision:

Kua O Ka Lā has adopted the concept of `Ke Ala Pono – The Right Path – to describe our goal of nurturing and developing our youth. We believe that every individual has a unique potential and that it is our responsibility to help our students learn to work together within the local community to create a future that is pono – right.