Base Power: Eighty percent of the feed source (oil, geothermal energy, biofuels) that an electric utility uses to produce electricity must result in what is called “base load” power. Base Load Power is the power that keeps electricity flowing smoothly to customers, so there aren’t rolling blackouts and flickering lights.

Because 80 percent of the utilities’ power must be base load power, one should pay close attention to the cost of that base load power.

Intermittent Power: The other 20 percent, made up mostly of sun power and wind power, is “intermittent power.” Big Wind falls into the 20 percent category.

O‘ahu depends overwhelmingly on oil for its base power. The utility could import biofuels, but biofuels are much more expensive than oil.

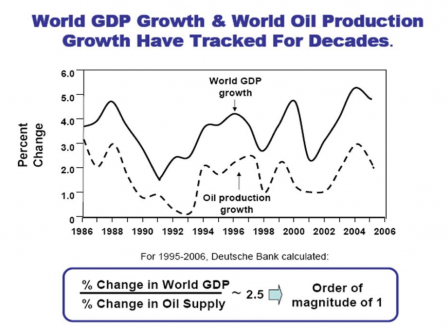

The International Energy Association, which represents the “rich” countries of the world, warns that the era of cheap oil is over.

In Jan 2011, the cost to generate electricity from oil was approximately 16 cents per kWh. By June (when oil was close to $100 per barrel) this had increased to 22 cents/kWh.

Barrons and Goldman Sachs predict that oil will cost $150/barrel within two quarters, and so we can guess that the cost to make electricity from oil may be more than 30 cents/kWh.

And Lloyds of London warns of $200 oil by 2013 – so 40 cents/kWh to make electricity? That’s less than two years from now, and almost double what it costs now.

By contrast, electricity from geothermal is estimated to cost around 10 cents/kWh and this would not change much over the years. Jim Kauahikaua, the chief scientist at the Hawaii Volcano Observatory, told me that the Big Island would be over the hot spot that generates geothermal activity for 500,000 to a million years.

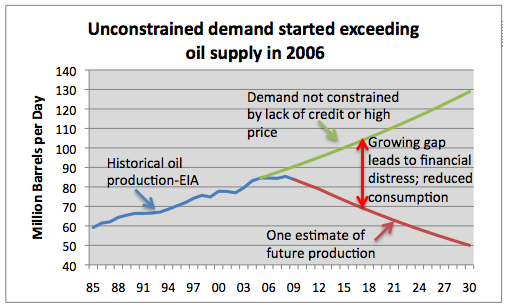

Below is one estimation of the world’s future oil supply. In spite of rising prices, world oil supply has not increased since 2004. Keep in mind that we may not have started to drop down the backside of the world oil supply curve – YET.

Oahu is in trouble!