I was part of a panel discussion of the Hawaii Venture Capital Association, which presents a monthly professional meeting at the Plaza Club in Pioneer Plaza in Honolulu.

The topic was “The Renaissance of Agriculture in Hawaii.” Panel members were Darren Demaya of Kai Market at the Sheraton Hotel; Claire Sullivan of Whole Foods; Andres Albano of CB Richard Ellis; Kyle Datta of Ulupono Initiative, and myself.

Someone told me they thought the attendance at this event was exceptional. I thought, “Everyone likes to eat.”

Gubernatorial Candidate Neil Abercrombie sat with Kyle Datta and I before the event started. He told us that his style of operating is to ask the folks who know a subject to give their opinions on what should be done and how to do it. He said, I rely on you guys to get it done; you’re the experts.

At the end of this post is the speech I gave, as written. But, as always, I started winging it from the start.

I began by saying that I have the answer to the problem. After I let that sit for a few moments, I told them what it is:

“Food security is about farmers farming, and if farmers make money, farmers will farm.”

That’s all there is to it, I told them; it isn’t rocket science.

I told the group that my Ag and energy blog is called hahaha.hamakuasprings.com, and that it represents three generations of the Ha family. I told them that I just got an email from Gordon Vredenberg, my buddy from 7th grade who lives on the mainland now. He told me, “I ran across your blog, and boy, things have changed. There was a time that if someone repeated your last name twice in a row, there would be a scrap right there.” The audience laughed.

I repeated my phrase, “If the farmer makes money, the farmer will farm,” several times in my talk. I could tell it stuck.

Later, when someone asked what the future of agriculture might look like, I answered, “If the farmer…”

The audience cracked up. They knew the rest of the sentence: “…makes money, the farmer will farm.” It was a fun event.

But on a serious note, it was heartwarming to hear Darren Demaya and Claire Sullivan talk about their commitment to using locally grown produce. This helps “farmers make money.” Kyle Datta gave a high-level vision of how we are going to achieve food security.

Andres Albano presented a perspective that very few of us get to see. I didn’t know they were the ones responsible for marketing the entire C. Brewer land sale, which involved tens of thousands of acres. He described the value of the sugar infrastructure for food production, especially the water system. Of course, he is right.

After the panel discussion, people came over to talk. One person asked what I thought of large-scale, mechanized agriculture. I said that in the “new economy” it will be more important to have resiliency and redundancy, and so I prefer small- and medium-sized farming entities all over the state, instead of one giant industrial farm that might need to source foreign labor. It might cost a little more, but it will be a lot safer for all of us.

Lots of the conversation revolved around “If the farmer makes money, the farmer will farm.” I said that if the discussion strays and becomes a couple of steps removed from that basic thought, no sense waste the time. People really get that.

Here’s the talk I gave:

Renaissance of Agriculture

We farm 600 fee simple acres just outside of Hilo. We have 60 workers, and our primary products used to be bananas and hydroponic vegetables. Now they include sweet potatoes, sweet corn, taro, beans, etc. and will include more things. We have deep soil, three streams and three springs, and we are putting in a hydroelectric generator soon.

We are a family operation of three generations of Has. That is why our blog is called hahaha.hamakuasprings.com. We have been farming for more than 30 years.

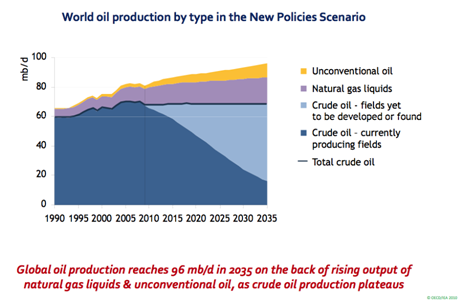

Several years ago, we noticed our farm input costs rising, and realized it was due to oil. We always try to position our company 5 to 10 years in the future, so in 2007 I went to the Peak Oil Conference in Houston to learn about oil. I learned that oil is finite, that the world is using 2 to 3 times more than we were finding and at some point we were going to find that we cannot produce more and then we will start down the backside of the oil supply curve. Sooner or later, we are going to face a new economy of higher oil prices.

Based on the idea that food security involves farmers farming and if the farmers make money the farmers will farm, we set out on a two-part Ag security plan for ourselves.

On a larger scale: We are promoting geothermal, the cheapest form of electricity base power. It would give folks discretionary income, so they could support local retailers and local farmers. That effort is ongoing.

And on our farm: We decided to transform our 600-acre fee simple farm from a one-entity production model to the “Family of Farms” model.

First thing we did back in 2007 was to pass legislation authorizing a special renewable energy farm loan program. It offers 3 percent, long term financing and is what we are using to help to finance our hydro project.

In June 2008, when oil price spiked and gas prices hit their peak, some of my workers asked to borrow money for gas to come to work. That was scary and clearly unsustainable.

We immediately decided to restructure our business to be relevant to the new economy. We knew that if farmers made money, farmers would farm and we wanted to add value for our retail customers. We began to implement our Family of Farms model. We decided to bring in area farmers to help keep the land in production.

To help farmers make money we:

- Offer low-rent land, cheap water, deep soil, and plastic covered houses to grow crops

- If farmers made money then we could make money by distributing

- It would give all of us economic reasons to stay together.

- Strengthen our brand by showing citizens that we are moving toward food security, giving them reason to support our brand.

- Add value for our retail customers, who are interested in shortening their supply lines in the new economy.

Results we hope for:

- Match our labor needs to the community.

- Farmers from the nearby community. They have their own houses.

- More productivity from our lands.

- Profitability is reason for us to stick together.

- More and varied food calories for the community.

Also, we are working with the USDA on a larger, zero waste program for the Hamakua Coast. We are working on renewable fuel projects that are appropriately scaled:

- Biodigester for rendering plant down the coast. End products might be fertilizer, compost, etc.

- Heterotrophic algae oil project that would get its carbon from our and others’ waste Ag products. Residual product to be animal/fish food.

To recap:

Considering the new economy is how we became directly involved in bringing the Thirty Meter Telescope (TMT) to Hawai‘i. It will help us transition and prepare our people on the Big Island for the new economy.

That is also why we are so involved in sourcing cheap geothermal for electrical base power. We are sitting on the largest battery in the world. The folks on the lowest rung of the economic ladder will get their lights turned off first if we choose expensive electricity. Too often they are Hawaiians. As oil prices rise, we become relatively more competitive to the rest of the world and our standard of living will rise relative to the rest of the world. Doing this will strengthen the aloha spirit.

The Family of Farms model brings us closer to our communities, while giving area farmers the opportunity to make money – because if the farmers make money, the farmers will farm. And for our workers we are actively planting ulu, bamboo, tilapia, etc. Since we have a difficult time raising our workers’ pay, we give them food from what we grow.

In the new economy, we will need stronger communities, we need to make more friends and stay closer to our families.

Not, no can. CAN!