Hundred dollar oil has been expected to have a recessionary effect.

On television last night, the Hawai‘i State Department of Taxation’s Council of Revenue gave a supplementary report on the effect of the Japan earthquake and resulting calamities on Hawai‘i’s economy. Chairman Paul Brewbaker said that there was an effect, but that a surprising general decline in tax collection had a larger effect. He said we should be aware of the decline, although he also pointed out that one month does not a trend make.

Two days ago, a Christian Science Monitor article explained that although there was a general rise in income during the last quarter, disposable income dropped due to a rise in fuel and food prices. The reduction in disposable income is close to wiping out the recent gains in income, and threatens our ongoing economic recovery:

US incomes rise, but disposable income drops. Blame oil prices.

A new report from the Department of Commerce shows average US incomes rising, but with rapidly-climbing fuel and food prices, ‘real’ disposable income is down.

By Mark Trumbull, Staff writer / March 28, 2011

American incomes continued to rise in February, but not enough to offset rising prices at the gas pump and grocery stores. The unwelcome shift points to a potential danger spot in the economic recovery – the risk that inflation could chip away at consumer well-being.

Overall, income from employment and other sources rose 0.3 percent in the US in February, on par with the trend over the past half year or so, according to a report released Monday from the Commerce Department. Consumer spending rose even faster, by 0.7 percent – partially due to growing confidence in the staying-power of an economic recovery.

But as the recovery has taken hold, so has an upward trend in prices for basic commodities like grains and gasoline. In February, US consumers were basically forced to spend more because of rising prices for groceries and fuel. Adjusted for consumer-price inflation, the gains in household earnings disappeared, with “real” disposable personal income actually falling 0.1 percent for the month…. Read the rest here

Gail Tverberg explains what is going on at the Oil Drum:

WSJ, Financial Times Raise Issue of Oil Prices Causing Recession

Posted by Gail the Actuary on March 28, 2011 – 10:39am

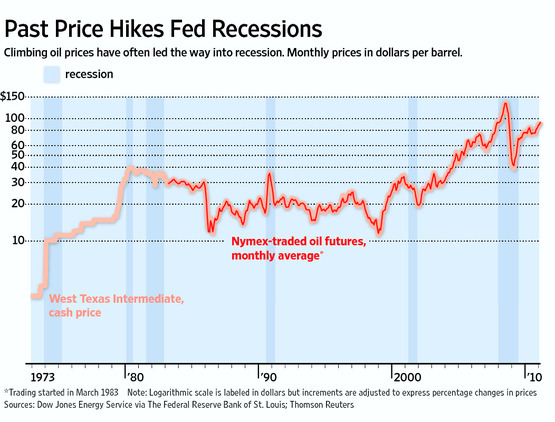

The idea that high oil prices cause recessions shouldn’t be any surprise to those who have been following my writings, those of Dave Murphy, or those of Jeff Rubin. Last month, though, the Wall Street Journal finally decided to mention the idea to its readers, in an article called “Rising Oil Prices Raise the Specter Of a Double Dip“. The quote they highlight as a “call out” is

When consumers spend more at the pump, they often cut back on discretionary purchases.

The WSJ shows this graph, linking oil price hikes to recessions:

Figure 1. Wall Street Journal graphic showing connection between oil price rise and recession.

Having been to three national Peak Oil conferences, I am not surprised to see a decline in economic activity associated with the recent rise in oil prices. It’s the new normal.

Love your blog. Hope lots of us are listening.