Richard Ha writes:

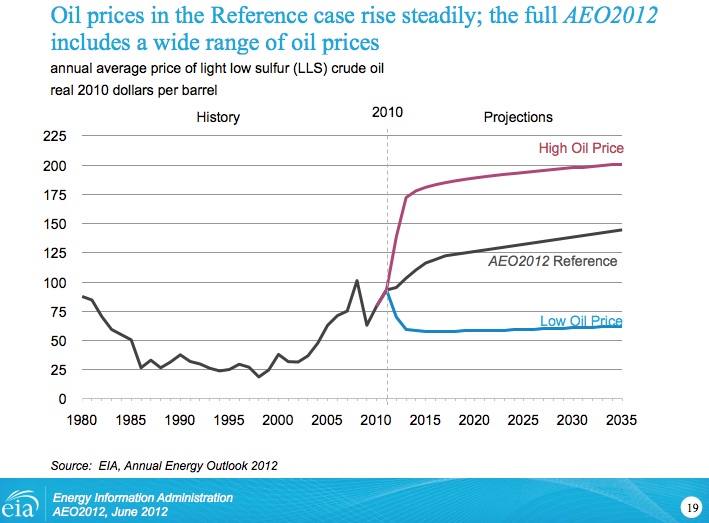

We don’t have the actual numbers, because HELCO hasn’t released them, but what if the agreement with Aina Koa Pono is that they get paid $200/barrel, and then the oil price follows the High Oil price curve of the AEO 2012 (see below)?

In that case, if oil is $175/barrel in 2015, then the rate payers would pay the remaining $25/barrel to enjoy the benefits of jobs, biochar and liquid fuel.

But what happens if Aina Koa Pono is wrong? What happens if the price of oil follows the reference line of this graph below, instead?

Say oil in 2015 costs $110. The difference between that $110 and $200/barrel is $90/barrel.

IS THAT WHAT THE RATE PAYER WOULD PAY IF THE ACTUAL COST OF OIL IS $110/BARREL? $90/BARREL?

This can’t be right.

SURELY THE CONSUMER ADVOCATE WOULD NOT LET THAT HAPPEN TO THE CONSUMERS?